Investing can feel overwhelming, especially when you’re bombarded with countless acronyms and financial jargon. Among these, ETFs stand out as an accessible and flexible option for many investors. ETFs, or exchange-traded funds, combine the diversification of mutual funds with the tradability of individual stocks, making them an attractive choice for beginners and seasoned professionals alike. In this guide, we’ll unpack what ETFs are, how they work, and most importantly, how you can use them to reach your financial goals without overcomplicating your portfolio.

Whether you’re curious about building wealth, saving for retirement, or simply exploring new investment ideas, understanding ETFs is a critical step. You’ll learn about different ETF structures, essential metrics like expense ratios and tracking error, and strategies that adapt to various market conditions. By the end of this article, you’ll have practical tips for evaluating ETFs, aligning them with your risk tolerance, and integrating them seamlessly into your long-term plan. Let’s dive into the world of ETFs together and demystify one of the most dynamic investment vehicles available today.

Defining ETFs and Their Role in Modern Portfolios

Exchange-traded funds, commonly referred to as ETFs, are pooled investment vehicles that hold a basket of assets such as stocks, bonds, commodities, or a mix of these. When you buy shares of an ETF, you gain proportional exposure to every asset in that basket. Unlike traditional mutual funds, which are priced once at the end of each trading day, ETFs trade on exchanges throughout market hours just like individual stocks. This hybrid structure gives investors flexibility and transparency, allowing real-time pricing, intraday trading, and the ability to establish positions through limit or stop orders.

Beyond these operational differences, ETFs play a vital role in portfolio diversification. By holding dozens, hundreds, or even thousands of underlying securities, an ETF can smooth out volatility tied to any single issuer. For example, a broad-market equity ETF might track the S&P 500, giving you exposure to large-cap U.S. companies across sectors. If one company underperforms, the impact on your overall position is limited. This risk-spreading characteristic is the cornerstone of why many investors—whether building a core portfolio or exploring niche asset classes—rely on ETFs to achieve balanced, cost-effective exposure.

How ETFs Work Behind the Scenes

At the heart of ETF mechanics lies the creation and redemption process. Authorized participants (typically large financial institutions) can create new ETF shares by delivering a predefined basket of the underlying assets to the fund provider. In return, they receive newly minted ETF shares. Conversely, redemption involves submitting ETF shares in exchange for the underlying assets. This process helps keep an ETF’s market price in line with its net asset value (NAV). When prices diverge, arbitrageurs step in, buying undervalued shares or selling overvalued ones, and capturing price discrepancies.

Another critical aspect is the ETF’s structure. Most ETFs are open-end funds, meaning they can issue or redeem shares continuously. Some ETFs use a unit investment trust (UIT) structure, which is less flexible but ensures transparency by publishing fixed portfolios. There are also synthetic ETFs, which use swaps or derivatives to replicate performance rather than holding the actual underlying assets. While synthetics can offer efficient tracking in hard-to-access markets, they introduce counterparty risk, so understanding each ETF’s structural details is essential when picking strategies for your portfolio.

Benefits of Including ETFs in Your Portfolio

When it comes to building or refining your investment strategy, ETFs offer several compelling advantages:

- Diversification By design, ETFs spread risk across a wide range of assets, sectors, or geographies. You can buy a single ETF and achieve exposure that would otherwise require multiple individual trades, reducing both time and transaction costs.

- Cost Efficiency ETFs typically have lower expense ratios than actively managed mutual funds because they often follow passive index strategies. These fees directly impact your long-term returns, so choosing low-cost ETFs can make a substantial difference over decades.

- Liquidity and Transparency Real-time pricing allows for intraday trading, limit orders, and even short selling. Additionally, you can view an ETF’s complete holdings daily, whereas some mutual funds update their portfolios only quarterly.

- Tax Advantages Thanks to the in-kind creation/redemption mechanism, ETFs generally distribute fewer capital gains than traditional mutual funds. This tax efficiency is beneficial for taxable brokerage accounts looking to minimize liability.

In my experience, these benefits can empower investors to stay disciplined, keep costs in check, and maintain clarity on their portfolio’s risk profile. Let’s explore how to sift through the crowded ETF marketplace to find the ones that truly align with your objectives.

Evaluating ETFs: Key Criteria to Consider

Choosing the right ETF requires more than picking the one with the lowest price or flashiest marketing. Here are crucial factors to compare before making a commitment:

- Expense Ratio: This annual fee, expressed as a percentage of assets, directly affects your returns. A 0.10% ETF costs $1 annually on every $1,000 invested. Small differences can compound significantly over time.

- Tracking Error: Indicates how closely an ETF follows its benchmark index. A lower tracking error means performance will be more faithful to the index. Persistent deviations may signal inefficiencies or high operating costs.

- Liquidity: Look at both trading volume and bid-ask spreads. Higher average daily volume and narrow spreads reduce transaction costs and ensure smoother entries/exits.

- Assets Under Management (AUM): A larger AUM suggests investor confidence and better economies of scale, often translating to tighter spreads and more stable operations.

- Underlying Index Methodology: Understand whether the ETF tracks a market-cap-weighted, equal-weighted, or fundamentally weighted index. Each approach emphasizes different companies and risk factors.

- Distribution Yield and Dividend Policy: For income-seeking investors, check how distributions are handled—monthly, quarterly, or reinvested automatically—and the historical yield data.

By systematically reviewing these elements, you’ll avoid pitfalls like unexpectedly high costs, stale holdings, or exposure to unintended risks. Bookmark resources like Investopedia’s ETF screener or your brokerage’s filter tools to expedite your research process.

Strategies for Using ETFs Effectively

One of the greatest strengths of ETFs is their adaptability to various investment philosophies. Here are some actionable strategies you can tailor to your needs:

- Core-Satellite Approach: Build the bulk of your portfolio (the core) with broad-market ETFs that capture large indexes like the MSCI World or the Bloomberg U.S. Aggregate Bond Index. Then use specialized ETFs (satellites) for targeted themes such as renewable energy, emerging markets, or real estate.

- Dollar-Cost Averaging: Automate fixed periodic investments into an ETF to smooth out market volatility. Over time, you’ll buy more shares when prices are low and fewer when prices are high, potentially lowering your average cost per share.

- Tactical Allocation: For more experienced investors, shift weightings between ETFs based on economic cycles or technical indicators. Increase exposure to defensive sectors via sector ETFs during downturns, then rotate back to cyclical areas as recovery takes hold.

- Income Laddering: Combine bond ETFs across maturities—short, intermediate, and long-term—to create a bond ladder that balances yield and interest rate sensitivity.

- Thematic and Smart-Beta Plays: If you have high conviction in megatrends like artificial intelligence or demographic shifts, thematic ETFs allow direct participation. Similarly, smart-beta ETFs target factors such as momentum, quality, or low volatility.

Pair these strategies with regular portfolio reviews—quarterly or semi-annually—to rebalance and ensure your risk-return profile stays on track. From my observation, disciplined rebalancing prevents small deviations from snowballing into unintended risks.

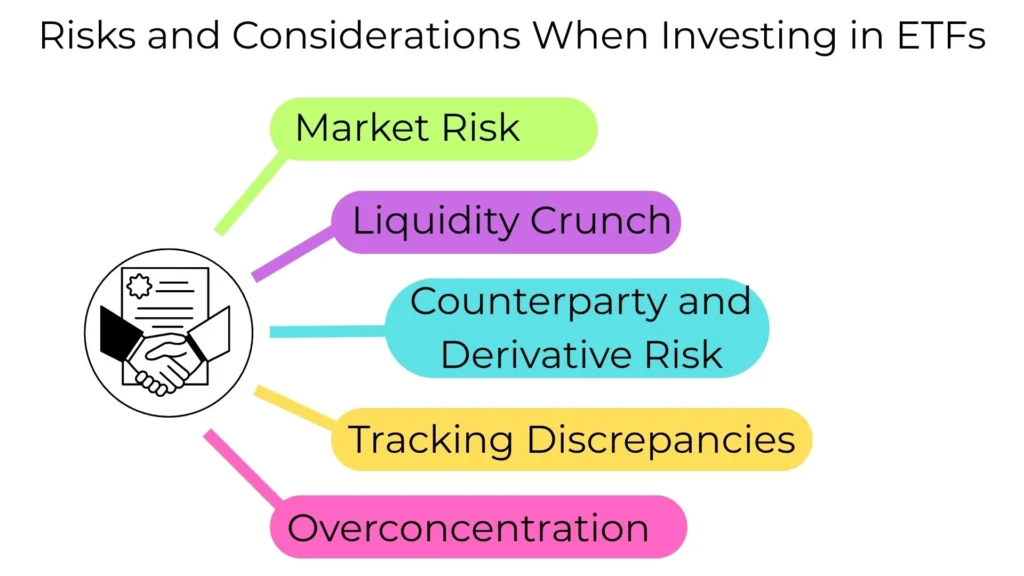

Risks and Considerations When Investing in ETFs

Despite their advantages, ETFs are not without pitfalls. Being aware of potential risks helps you manage them proactively:

- Market Risk: ETFs mirror market movements. A broad U.S. equity ETF will lose value when U.S. stocks decline. Always match ETF exposure to your risk tolerance.

- Liquidity Crunch: In extreme markets, some low-volume ETFs might experience wider spreads or delayed trades. Check daily volume and underlying asset liquidity, especially for niche or foreign ETFs.

- Counterparty and Derivative Risk: Synthetic ETFs rely on swap agreements. If the counterparty defaults, the ETF can suffer losses unrelated to the benchmark index.

- Tracking Discrepancies: High tracking error can erode returns. Factors like management fees, cash drag, and sampling methods can contribute to divergence from the underlying index.

- Overconcentration: Some ETFs, particularly sector or thematic ones, may heavily weight a handful of companies. Always review the top 10 holdings to gauge concentration risk.

Mitigate these concerns through due diligence: read the ETF’s prospectus, examine historical performance metrics, and consider how each fund fits into the broader portfolio mosaic. If a fund’s structure or strategy feels opaque, look for alternative ETFs with clearer methodologies.

Frequently Asked Questions about ETFs

What differentiates an ETF from a mutual fund? ETFs trade on exchanges with live prices, offer intraday transactions, and benefit from in-kind creation/redemption. Mutual funds price once daily, possibly triggering capital gains distributions.

Are ETFs suitable for retirement accounts? Absolutely. Their low cost, tax efficiency, and diversification make them ideal for IRAs and 401(k)s. Choose target-date ETFs or build a custom mix by selecting equity, bond, and specialty ETFs to match your horizon.

How do dividends work in ETFs? Most ETFs distribute dividends quarterly or monthly. You can receive cash payouts or opt for a dividend reinvestment plan (DRIP). Always verify the historical dividend schedule in the fund’s documentation.

Can I short or margin trade ETFs? Yes. Because ETFs trade like stocks, you can short them or purchase on margin. However, both strategies carry amplified risk and require a good understanding of market mechanics.

How can I compare ETFs quickly? Use your brokerage’s ETF screener or third-party sites such as ETF.com to filter by asset class, expense ratio, AUM, and other criteria. Create watchlists and set alerts for changes in price, volume, or distribution announcements.

Personal Observations and Tips for ETF Investors

I’ve worked with investors who hesitate to incorporate ETFs, viewing them as impersonal or overly generalized. Yet in practice, ETFs have democratized investing. Even with a handful of ETFs, you can build a sophisticated portfolio that rivals those of high-net-worth individuals. Here are some distilled tips:

- Start Small and Expand Gradually: Begin with two to four core ETFs—one global equity, one domestic bond, one international bond, and perhaps a real asset ETF like commodities. As you grow more comfortable, explore sector or thematic ETFs.

- Check Total Cost of Ownership: Beyond the expense ratio, account for bid-ask spreads, brokerage commissions (if applicable), and potential currency conversion fees for international ETFs.

- Automate Rebalancing: Several robo-advisors and brokerage platforms offer automatic portfolio rebalancing. This feature ensures that your ETF weightings stay aligned with your target allocation without manual intervention.

- Stay Educated on Index Changes: Indices evolve over time. Funds tracking an index that has reconstituted can see shifts in sector exposures. Subscribe to ETF provider newsletters for updates.

- Embrace Simplicity: You don’t need dozens of ETFs. A streamlined portfolio is easier to monitor and less likely to drift from your risk parameters.

By weaving these observations into your routine, you’ll transform ETF investing from guesswork into a systematic, disciplined practice. It’s the incremental optimizations—lowering costs, rebalancing intelligently, and staying informed—that drive meaningful gains over the long run.

Resources for Continued Learning

As you deepen your mastery of ETFs, leverage these reputable sources and tools:

- Investopedia: ETF Basics and Terminology

- ETF.com: Comprehensive ETF Data and Analysis

- Vanguard’s ETF Center: Educational Articles and Fund Details

- SEC’s Investor.gov: ETF Regulatory Filings and Prospectuses

- Morningstar: ETF Ratings and In-Depth Research

Bookmark these sites and allocate time each month to review market commentary, new product launches, and changing fee structures. Continuous learning ensures you stay ahead of trends like environmental, social, and governance (ESG) ETFs or cryptocurrency-related funds.

Conclusion: Embracing ETFs in Your Financial Journey

ETFs represent a transformative evolution in how everyday investors access global markets. Their blend of diversification, cost efficiency, and transparency equips you to build robust portfolios tailored to your goals. From passive core holdings that track broad indexes to active thematic plays riding emerging trends, ETFs offer a universe of choice. By focusing on expense ratios, liquidity, and index methodologies, you can navigate potential pitfalls and select funds that align with your risk profile.

Investing in ETFs isn’t about chasing the latest fad; it’s about establishing a clear, repeatable process. Define your objectives, choose a disciplined allocation strategy, and revisit your portfolio regularly. Over time, the consistency and simplicity of ETFs will compound into tangible wealth gains and greater confidence in your financial roadmap. Now that you’ve gained a solid foundation, take the next step: open your brokerage account’s ETF screener and start mapping out a personalized ETF lineup. This hands-on exploration will crystallize your understanding and lay the groundwork for sustained success in the markets.